Select the ideal real estate location in Crete: When evaluating real estate investment opportunities in Crete, selecting the ideal location is a critical decision based on factors such as property values, available amenities, and future development potential. A well-considered choice of location can significantly impact both the immediate value and long-term success of the investment.

Why Location Matters in Crete’s Real Estate Market

Location is a determining factor that directly influences property prices, potential return on investment, and overall lifestyle quality. High-demand areas such as coastal regions, historical districts, and city centers often command premium property values and offer higher rental yields.

In Crete, regions like Chania, known for its historical significance and charming Venetian harbor, and Heraklion, the island’s capital and commercial hub, are particularly sought after. Coastal areas such as Elounda and Agios Nikolaos are renowned for luxury properties and stunning views, driving demand among high-end buyers. Meanwhile, areas like Rethymno offer a blend of historical appeal and modern amenities, attracting both investors and those seeking a high-quality lifestyle.

These prime locations attract not only investors seeking profitable returns but also individuals looking for an exceptional living experience, thereby amplifying both the short-term and long-term value of the investment. Proximity to amenities, infrastructure developments, and future growth prospects also play a pivotal role in shaping property demand and market trends across Crete.

Key Factors for Selecting the Ideal Real Estate Location in Crete

Choosing the Ideal Real Estate Location in Crete requires a thorough evaluation of several critical factors:

- Proximity to Amenities: Accessibility to essential services such as schools, healthcare facilities, shopping centers, and transport links can significantly affect both property value and desirability. Areas like Heraklion and Rethymno benefit from well-developed infrastructure and urban conveniences.

- Infrastructure Developments: Planned infrastructure improvements, such as new roads, public transport systems, and upcoming projects, can enhance the value of nearby properties. The Heraklion Airport expansion and other roadworks are examples of developments that influence property values in the surrounding regions.

- Tourism Potential: High tourist traffic drives up demand for short-term rentals, leading to increased rental income. Popular coastal areas such as Elounda and Agios Nikolaos, known for attracting luxury tourism, present significant opportunities for investors looking to capitalize on Crete’s booming tourism sector.

- Local Real Estate Trends: Monitoring price appreciation trends in specific regions helps investors make informed decisions. For instance, Chania and Heraklion have seen steady increases in property values due to growing demand for both residential and investment properties.

Facts & Figures

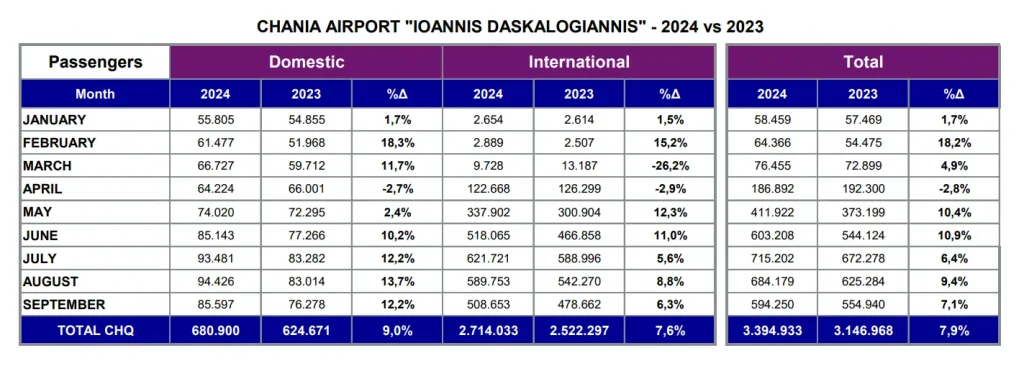

The traffic development overview for Chania Airport (“Ioannis Daskalogiannis”) shows a steady increase in both passenger numbers and flights in 2024 compared to 2023. Passenger traffic grew by 9% overall, with international traffic up 7.6% and domestic by 9%.

Key months like August and September saw significant increases, particularly in international travel. Similarly, flight activity increased by 6.9%, with strong growth in both domestic (8.5%) and international (6.3%) sectors, highlighting a positive trend in the airport’s traffic development.

For detailed data, refer to the full report here.

Chania: A Prime Example of the Ideal Real Estate Location in Crete

Chania is one of the most popular regions for property buyers. The city’s mix of history, culture, and stunning landscapes makes it a standout for both residential and commercial real estate. Below is a table that highlights the average property prices in Chania and how it compares to other regions.

Chania’s real estate market has seen significant growth over the past few years, characterized by rising property values and a strong demand for both residential and vacation homes. The average price per square meter in central Chania has increased to approximately €2,300 in 2023, reflecting a 15% rise from 2021. The area is particularly attractive to foreign investors, drawn by its rich history, stunning architecture, and proximity to beautiful beaches.

Furthermore, Chania benefits from ongoing infrastructure developments, such as the expansion of the local port and improvements to public transportation, which are expected to further enhance property values and attract more buyers. This dynamic market is complemented by a vibrant tourism sector, making Chania one of the most sought-after locations for real estate investment in Crete.

Table 1: Average Property Prices in Chania (per square meter)

| Year | Central Chania (€/m²) | Suburban Chania (€/m²) | Coastal Villages (€/m²) |

|---|---|---|---|

| 2021 | €2,000 | €1,600 | €2,400 |

| 2022 | €2,150 | €1,750 | €2,550 |

| 2023 | €2,300 | €1,900 | €2,700 |

Data Source: ARENCORES

Chania has experienced consistent price growth, driven by its increasing appeal among both locals and international buyers. For those looking for the ideal real estate location in Crete, Chania provides a stable and lucrative investment.

The Sustainable Factor in Selecting the Ideal Real Estate Location in Crete

One unique aspect to consider when selecting the Ideal Real Estate Location in Crete is the growing trend of sustainable real estate development. Crete is becoming a leader in environmentally friendly construction, with a focus on energy-efficient homes, biophilic design, and the use of renewable energy sources. This shift is driven by both government incentives and growing awareness among buyers about reducing their carbon footprint.

Why Sustainability Adds Value

Properties that incorporate solar energy systems, green roofs, and natural building materials are increasingly in demand. These homes offer not only lower utility costs but also a unique selling point for future resale or rental opportunities. For instance, in Chania and Heraklion, developers are increasingly integrating sustainability features into both new and renovated properties.

Table 2: Impact of Sustainable Features on Property Prices in Crete

| Sustainable Feature | Average Price Increase (%) | Appeal to Buyers (%) |

|---|---|---|

| Solar Panels & Renewable Energy | 8% | 85% |

| Green Roofs & Insulation | 6% | 80% |

| Passive House Standards | 10% | 90% |

Investors looking for the ideal real estate location in Crete can benefit from properties in eco-conscious developments, as these will likely appreciate faster in value due to the increasing demand for sustainability in real estate.

Coastal vs. Inland: Where to Find the Ideal Real Estate Location in Crete?

Finding a location with a high Return on Investment potential, requires careful consideration of various factors that align with your investment goals and lifestyle preferences. Start by exploring the vibrant city centers, like Chania and Heraklion, known for their rich cultural heritage, modern amenities, and strong rental markets. Coastal areas, such as Elounda and Agios Nikolaos, are perfect for those seeking scenic views and beach access, while inland villages like Archanes and Vamos offer a more tranquil lifestyle with potential for growth as they become increasingly popular among expatriates and retirees.

Additionally, consider areas with planned infrastructure developments, which often lead to rising property values. Research local amenities, schools, healthcare facilities, and transport links to ensure the chosen location meets your needs. By evaluating these factors, you can identify the ideal spot that not only offers immediate benefits but also long-term investment potential in Crete’s dynamic real estate market.

Each region of Crete offers unique benefits, but there’s a marked difference between coastal and inland locations. Coastal properties tend to be more expensive due to their proximity to the sea and tourist hotspots. Meanwhile, inland areas offer more affordable options with potential for future growth as infrastructure expands.

Table 3: Coastal vs. Inland Property Price Comparison (2023)

| Region | Coastal Properties (€/m²) | Inland Properties (€/m²) |

|---|---|---|

| Chania | €2,700 | €1,800 |

| Heraklion | €2,500 | €1,700 |

| Rethymno | €2,300 | €1,600 |

| Lasithi | €2,100 | €1,500 |

Choosing between coastal or inland depends on your budget and investment goals. For high rental yields, coastal locations like Chania or Heraklion are ideal, while inland areas like Rethymno offer more affordable options with growth potential. Platforms like Datanalytika offer valuable historical property price data for Crete, serving as a unique resource for accessing detailed insights into past trends and current market conditions, enabling better-informed financial planning for real estate investments.

Comprehensive Market Research and Analysis

ARENCORES conducts comprehensive market research, systematically monitoring real estate market developments and prospects in Crete.

Our goal is to provide reliable data and insights for both buyers and sellers. To achieve this, ARENCORES compiles the Greek Real Estate Price Indices, utilizing primary data and assessments on property values, market trends, and quality parameters for both residential and commercial properties.

This meticulous approach ensures that our clients have access to the most accurate and up-to-date information to make informed decisions in the real estate market of Crete.

Unique Insights for Buyers and Investors

When searching for the perfect real estate opportunity in Crete, it’s essential to consider various factors that influence both market viability and lifestyle appeal. One unique aspect to explore is community-centric development. Areas that integrate residential, commercial, and recreational spaces foster social interaction and enhance quality of life, making them highly desirable for buyers. Cities like Chania and Rethymno are leading the way in this trend, creating vibrant neighborhoods that attract residents and investors alike.

Additionally, the focus on sustainability (e.g., Passive Houses) is reshaping the real estate landscape. Buyers should prioritize regions where eco-friendly practices and resilience strategies are being implemented. Properties in these areas not only appeal to environmentally conscious consumers but also benefit from policies that enhance long-term value.

Cultural and historical appeal also plays a significant role in property desirability. Locations rich in heritage, traditional architecture, and local festivals, such as Heraklion and Agios Nikolaos, attract buyers seeking an authentic living experience, further ensuring that investments yield emotional as well as financial returns.

Finally, understanding local economic conditions, such as job growth and tourism trends, is crucial for identifying areas with significant growth potential. For instance, Elounda has gained popularity among investors due to its stunning coastal views and upscale developments. By focusing on these multifaceted factors, investors can make informed decisions that lead to successful real estate ventures while contributing positively to the communities in which they invest.